The headlines in 2021 and much of 2022 were virtually unanimous, The Energy Transition was well underway. We had major oil companies declaring their commitment to Net Zero across the world. To the public it seemed like the discussion was over, the debate was done. To governments the deadlines for such a transition became definitive, some as early as 2030 with many others setting the goal line between 2035 and 2040.

The headlines today, especially after the Trump re-election, provide an almost opposite outlook. Fossil Fuels it seems are not going to be gone in five years, or fifty. Automakers are announcing massive losses on their EV investments. New challengers to Tesla who raised almost unlimited capital just months ago are burning through the remainder of their cash and their public share prices are plunging towards zero. The inflation reduction act, which was anything but, provided billions for chargers and infrastructure to support EV’s, much of which is apparently spent, but with no actual chargers to show for the investment of taxpayer dollars.

So, as the headlines whipsaw us from one outlook to the other, and with 2030 now only five years away, what do the latest data say about where we really stand? The reality compared with either end of these outlooks is widely disconnected with either view.

Just how disconnected depends a lot on where you live. To avoid the distraction of smaller markets let’s just stick to the two biggest ones, China and the US. The worlds two largest demand centers are on increasingly divergent paths. The destination may ultimately be the same, but the schedule is looking dramatically different.

China essentially just hit 50% of new vehicle sales for EV’s, (Figure 1). Sure there is some noise in the data, and this is China so quality of reporting is always suspect. That aside if it’s 40% or 55% doesn’t really matter, it is by any measure very far along. The fuel transition for light duty vehicles has indeed arrived if you live in a metro Chinese market. It will still take a decade or even two to turn the fleet at these sales rates, but it will turn over and gasoline demand will be dramatically impacted.

While it is still small we are possibly seeing the first impacts on oil demand from this level of EV penetration. China, which accounted for half of all oil demand growth in the world over the past 20 years, looks to have hit an inflection point, losing over 2 million barrels a day of demand over the course of 2024, (Figure 2). There is a recession afoot in China, so it’s important to not over rotate on this data point, but at around 50% adoption rate for new vehicle sales we are going to see an impact.

Contrast the situation in China with the US. The US market has hit an important milestone. Double digit EV sales as a % of the new vehicle market, eclipsing 10% for the first time after hovering below 5% penetration for many years, (Figure 3).

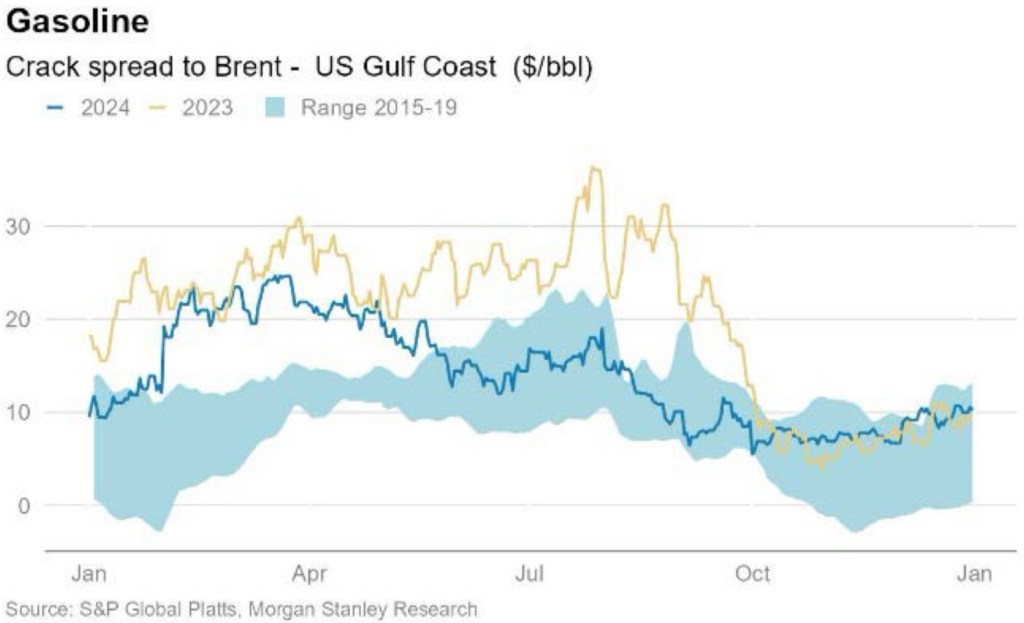

Does this 10% milestone mean anything in terms of overall gasoline demand for the US? It seems to be showing up in a number of places, including gasoline cracks which didn’t have the summer run up this year that we normally expect, (Figure 4). For many years it was fairly predictable to have a run up on gasoline refining margins that supported the summer driving season.

July and August in 2023 were higher than normal, but even in normal years the summer spike was expected. This year was different as 2024 rolled into summer gasoline cracks just kept on declining. There was no demand growth pulling them up into summer and cracks in July were lower than April, around 50% lower.

Does the lack of gasoline refining margin in the summer really indicate an early phase of demand destruction from EV’s? It’s hard to draw a direct conclusion as run rates, turn around schedules, inventory levels and many other factors all have a meaningful impact on refining margins.

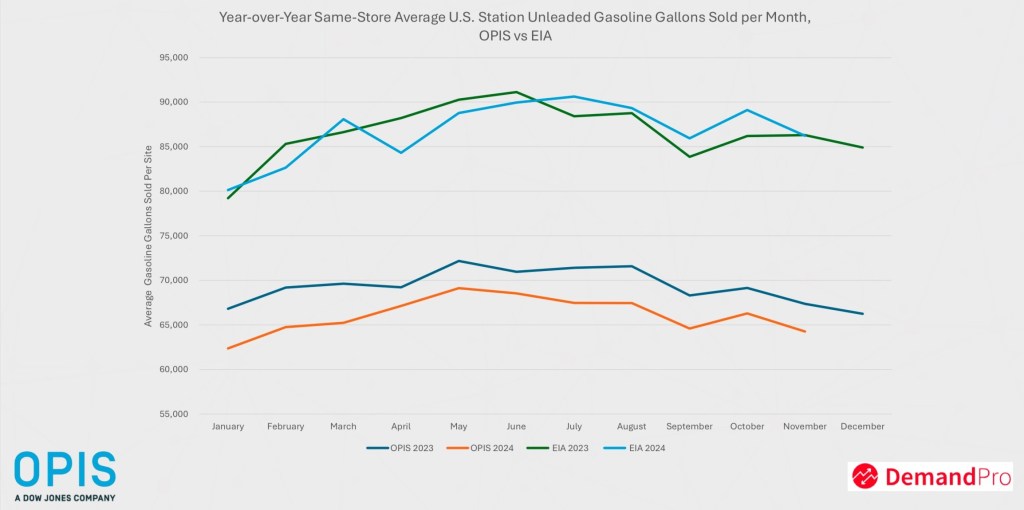

Looking further downstream for other indicators however does seem to show that something is taking a bite out of gasoline demand. OPIS, a gold standard for downstream fuels pricing and demand data, recently published their Retail Year in Review report. While there are a number of trends apparent in the report, one fundamental stands out. Gasoline demand, as measured by OPIS’s proprietary methods, declined by 5% in the US from 2023 to 2024, (Figure 5).

So has the fuels portion of the grand declarations of Energy Transition arrived, is it delayed, or is it never coming? The truth seems to be that it is indeed underway, very slowly, but becoming noticeable even in markets like the US that are far behind China or the EU. The latest data at the end of 2024 show that change is in fact happening. Not nearly as fast as those grand 2022 declarations predicted, but it’s not nothing, 1 in 10 new cars sold is a lot of customers.

Fuel refiners, suppliers, distributors and retailers who buy into the post Trump fossil fuels forever narrative might do well to take a more balanced view, but there is certainly time to adjust. The best operators will use this time wisely to carve out their share of those 1 in 10 customers. They will learn enough about their return on those early investments to create a successful future, even if it does take a few more years to arrive. A great narrative is certainly powerful, but often they are powerfully wrong. In the end, get the data, and do the work.

Leave a comment