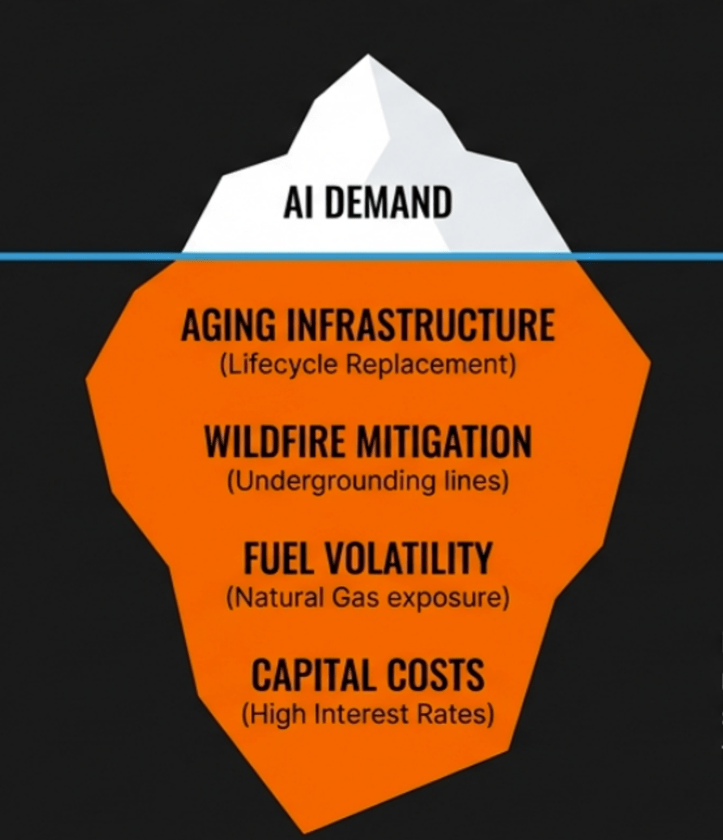

As global oil markets evolve in response to tariffs, sanctions, policy, geopolitics, and seasonal shifts, April 2025 reveals some intriguing differences—and a few similarities—between China and the U.S.

With the first quarter behind us and data starting to come out for oil and products supply and demand trends it seemed useful to look across the two biggest drivers of these markets to do a little compare and contrast. What becomes evident is that China is undergoing a major structural shift. EV adoption continues to race ahead of the US and gasoline demand is showing measurable demand destruction even with a small comeback this quarter from the dramatic numbers at the end of last year.

What is having a similar impact on diesel is the dramatic advance of natural gas powered engines in the heavy duty transport sector. While we have seen a bit of this in the US it has not been material enough to reset diesel demand levels. In China we seem to be seeing a material impact on diesel volumes and the adoption of CNG and LNG engines continues to expand.

The US seems to be having the fairly normal shifts we see this time of the year as the refining complex gears up for max gasoline production to support the summer driving season and diesel and heating oil demand pressures ease as winter turns to spring. What does seem to becoming more of a structural trend is a lack of gasoline demand overall.

While likely driven as much by fuel economy gains and continued work from home policies as compared with the massive EV adoption being seen in China, it is nonetheless concerning for refiners. Already presented with the thin gasoline cracks that always seem to come with the snows of winter they do not seem to be opening up quite as much as we would expect headed into summer.

My top 5 comparative trends based on this weeks inventory and demand data in both markets:

1. 🛢️ Crude Stock Movement: Divergence in Timing

- China: Crude stocks dropped sharply in Jan-Feb due to sanction-related import disruptions, but rebounded in March as workaround routes resumed.

- U.S.: Stocks climbed by 6.5 million barrels last week, driven by lower exports, higher imports, and steady production.

🔍 Takeaway: China’s volatility was sanctions-driven; the U.S. is seeing a classic oversupply build.

2. ⛽ Gasoline Demand: EV Drag in China vs. Tepid U.S. Driving

- China: Despite record travel during Lunar New Year, EV penetration muted gasoline gains, pushing demand slightly below YoY.

- U.S.: Gasoline drew seasonally, but implied demand remains soft—perhaps a signal of economic caution or efficiency gains.

🔍 Takeaway: Both markets saw weaker-than-expected gasoline usage, but for different structural reasons.

3. 🚛 Diesel: China’s Demand Dip vs. U.S. Seasonal Rebuild

- China: Diesel demand fell sharply—down 170 kb/d YoY—as LNG trucks gained share and construction lagged.

- U.S.: Diesel inventories began building, as heating oil season ended and trucking activity has yet to peak.

🔍 Takeaway: China’s diesel decline is structural, U.S. shifts are more seasonal.

4. 🏭 Refinery Activity: China Surges, U.S. Winds Down

- China: Refineries ran at seasonal highs in Jan-Feb, prepping for holidays and spring construction.

- U.S.: Refinery runs fell 190 kbpd last week as spring maintenance took hold in the Midwest.

🔍 Takeaway: While China front-loaded its output, U.S. capacity is tightening in the short term.

5. 🛢️ Fuel Oil: Supply Builds in Both, But Different Drivers

- China: Demand dropped 40% YoY due to fuel oil tax changes and margin compression for independent refiners.

- U.S.: Fuel oil stocks rose, likely reflecting export slowdowns or seasonal adjustments in marine fuels.

🔍 Takeaway: Both countries saw fuel oil builds, but China’s was policy-induced, U.S. more operational.

Final Thought

China’s oil markets are being reshaped by policy shifts and long-term transitions (e.g., EVs, LNG freight), while the U.S. is navigating short-term seasonal and logistical changes. As global demand patterns continue to diverge, especially with a major trade war clearly upon us, watching how these two giants evolve this year will be the essential storyline of the oil and products markets.

Leave a comment