With oil prices declining so much this year are there other upsides in the oil and energy outlook that might cushion the blow of lost revenues and earnings from oil? The latest report from Morgan Stanley would offer some promising possibilities for companies with significant roles in the natural gas industry from production and processing to transportation and marketing. Rapid demand growth driven by AI looks very attractive now, but is this just a medium term impact with Nat Gas serving as a bridge for the next decade or a longer term play for the industry? Several factors seem to indicate a long term runway and maybe even a backbone role for the fuel.

Summary below:

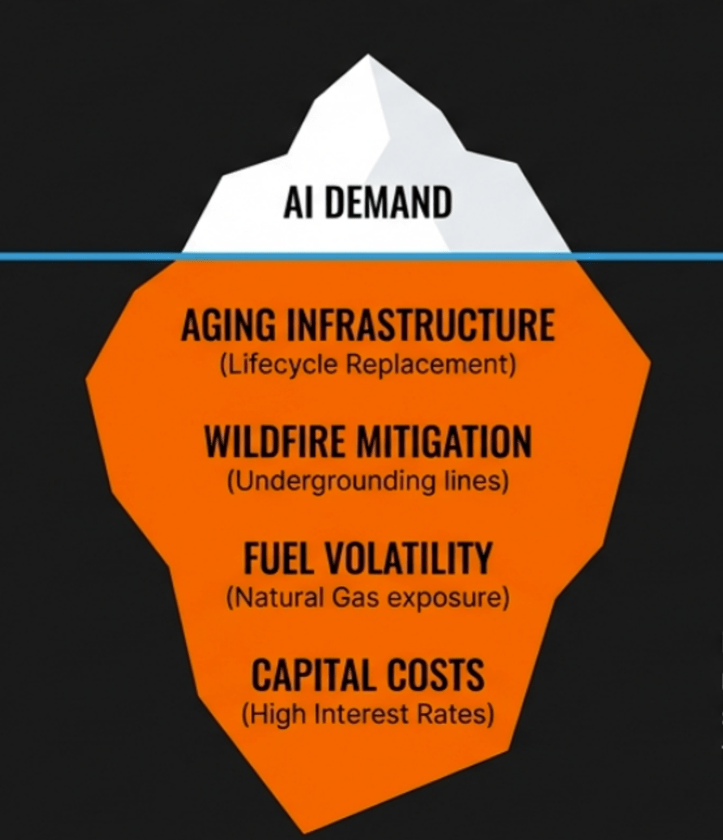

🔌 AI and Electrification Are Supercharging Power Demand – GenAI, electrification of transport and industry, and reshoring of manufacturing are driving unprecedented power demand globally. Asia’s data center capacity is expected to triple by 2030, requiring 14 million tonnes per annum (mntpa) of additional natural gas to power them. Gas offers a flexible, lower-carbon solution for round-the-clock baseload power, especially where renewables fall short due to intermittency.

🌏 Asia Is the Center of Demand Growth – Morgan Stanley projects Asia-Pacific natural gas demand to grow at 5% CAGR (2024–2030)—twice consensus estimates. Asia will consume ~70% of globally traded LNG by 2030, largely from the U.S., Qatar, and Australia. Infrastructure is scaling fast: over 200 mntpa in new import capacity and 250+ LNG ships create a virtual pipeline from the U.S. to Asia. Major markets driving this include India, China, Japan, and Southeast Asia, fueled by policy shifts, data centers, and transport.

🚢 The U.S.-Asia LNG Trade is Booming – Natural gas exports from the U.S. to Asia could reach $60 billion annually by 2030. This trade benefits both sides: reduces Asia’s trade surplus with the U.S., lowers energy costs in Asia, and supports U.S. upstream and midstream players.

🔋 Natural Gas vs. Alternatives – Gas is increasingly competitive with coal and propane, especially with renewable intermittency and nuclear’s long lead times. It plays a balancing role alongside renewables and is preferred in price-sensitive markets. AI workloads and data center growth will increase gas consumption in regions like Malaysia, Singapore, and Japan.

📉 Risks and the Other Side of the Outlook – Slower-than-expected fuel demand due to macro headwinds. Delays in U.S. LNG project buildouts

Faster coal or diesel phaseout than modeled. Overestimation of AI power demand if efficiencies outpace forecasts.

My View:

💥 Natural Gas is Not Just a Bridge Fuel but a Backbone – Natural gas is becoming less elastic to price changes, reflecting a structural shift in its role—now central to energy systems, not just transitional. Power market reform (shift to spot trading from long-term PPAs) could further integrate gas into competitive energy mix.

Leave a comment