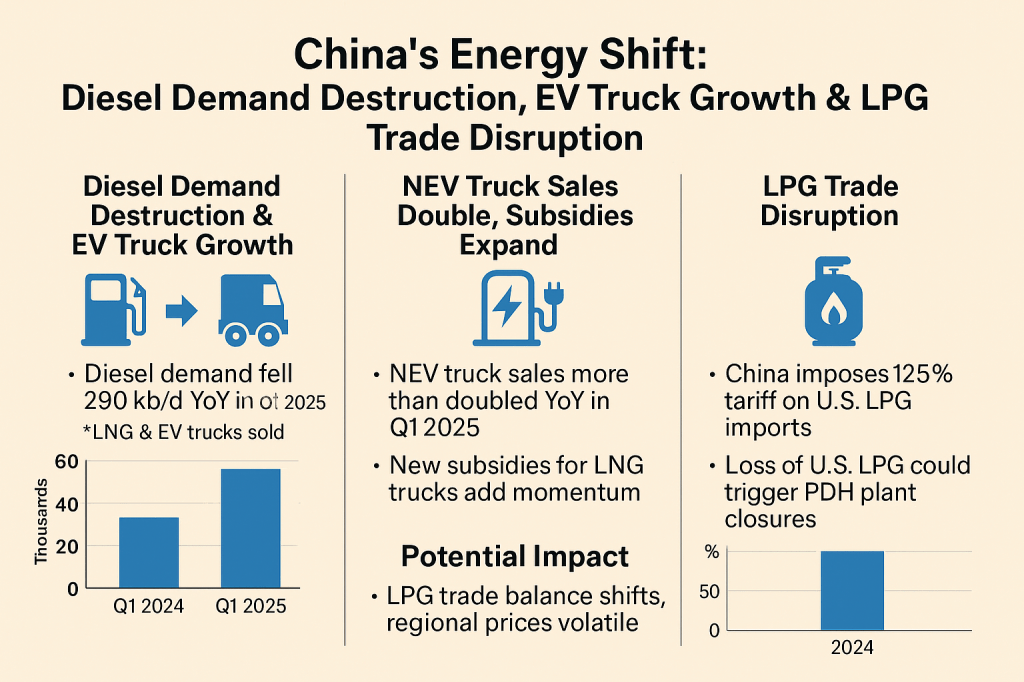

The latest data on oil and products demand in China reveals that some energy transition trends are starting to hit demand in heavy-duty transport and the trade war and tariffs are showing up in the petrochemical sector.

We haven’t seen any trends in the US that would indicate a threat to diesel demand due to EV’s or any appreciable growth in LNG/CNG use, which has been growing slightly but not enough to dent diesel demand, so a real divide in how the commercial trucking sectors are evolving is now starting to look material.

🔻 Diesel demand destruction is accelerating as LNG and new energy vehicle (NEV) trucks take market share. While diesel demand rose slightly MoM in March (+50 kb/d), it remains down 290 kb/d YoY. Over 47,000 LNG and NEV heavy trucks sold in Q1 2025 are estimated to have displaced 30 kb/d of diesel—a trend set to continue with fresh subsidies for LNG vehicles.

⚡ NEV truck sales more than doubled YoY and subsidies are expanding. Electrification isn’t just for passenger vehicles anymore—heavy-duty fleets are catching up fast.

🌍 Global propane/LPG markets face new turbulence as China imposes 125% tariffs on U.S. LPG imports. Given that 55% of China’s LPG came from the U.S. in 2024, this shift is material. The costlier pivot to Middle Eastern LPG is squeezing Chinese steam cracker margins and could trigger closures at propane dehydrogenation (PDH) plants.

📉 Impact: This trade disruption may alter the global balance in LPG flows, raise regional price volatility, and dent U.S. export volumes.

💡 Takeaway: Structural shifts in fuel demand and trade policy are reshaping energy flows and are sure to inject more volatility. From NEV trucking to tariff-driven feedstock switching, the ripple effects will be global.

Leave a comment