As we near the midpoint of 2025, energy investors and industry watchers are grappling with a shifting outlook. Brent crude prices have declined meaningfully this quarter, and according to Morgan Stanley’s latest Energy Sector Investment Review, the road ahead for oil companies is likely to remain challenging. While the long-term fundamentals of global energy demand persist, a combination of near-term oversupply, tariff-driven demand weakness, and reduced investor enthusiasm for buybacks sets a more cautious tone for the sector.

Will this trend play out until year end or does the recent Trade War détente between the US and China restore some confidence in global economic activity? Will the US and Isreal strike at Iran and introduce a big risk premium into the crude price? Either could certainly happen but without a major cooling of the trade war or a strike on Iran we could be in for a lower for longer kind of year.

Sector View Turns Cautious

Morgan Stanley has downgraded its view on the European energy sector from “In Line” back to “Cautious” as of May 2025. The reasons are straightforward:

- Oil prices are under pressure. After relative strength earlier in the year, Morgan Stanley forecasts Brent to average just ~$57/bbl in 2026, down from ~$63 this year.

- Surplus is returning. The global oil market is expected to enter a surplus of 1.4 million barrels per day (mb/d) in Q4 2025, widening to nearly 1.9 mb/d in 2026.

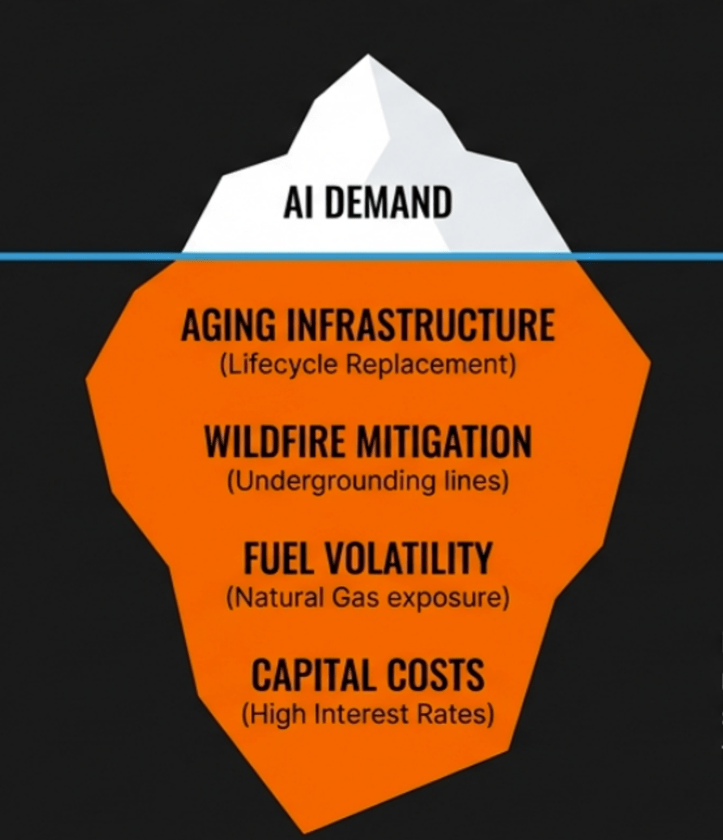

The Oil Market Setup: A Triple Headwind

Morgan Stanley identifies a “triple headwind” driving oil market softness:

- Weaker demand due to global trade tariffs, impacting energy-intensive sectors.

- Non-OPEC supply growth rebounding after a flat 2024.

- OPEC+ unwinding cuts faster than anticipated.

These forces collectively push the market into surplus, pressuring inventories higher and sending prices lower. In this environment, earnings, capex, and buybacks face renewed scrutiny.

Key Takeaways

- Defensiveness matters: Companies with strong balance sheets and integrated models are better positioned.

- Buyback fatigue is real: Expect slower repurchase activity across the board.

- Natural gas exposure is a mixed bag: It offers upside but is clouded by broader capex concerns.

- Watch gearing trends: Rising net debt could pressure share performance even if oil prices stabilize.

Despite the challenging backdrop, company valuations on a historical basis appear average, not cheap. For example, the sector trades at 3.9x consensus CFFO (cash flow from operations), but adjusting for Morgan Stanley’s lower earnings estimates, that climbs closer to 5x — approaching a 2 standard deviation premium.

Energy transition pressures and geopolitical uncertainties haven’t gone away, but in the near term, traditional fundamentals — price, supply, demand, and cash flow — are once again driving the narrative.

Leave a comment