In 2025 the United States stands at a pivotal moment in its journey toward energy dominance, a cornerstone of the Trump administration’s “America First” strategy. According to a recent Wood Mackenzie whitepaper, Horizons: Tough at the Top – The Threats to US Energy Dominance, the U.S. has emerged as a global leader in oil and gas production, outpacing traditional powerhouses like Saudi Arabia and Russia.

For most of my life we talked about energy independence as the primary political and industrial objective for the industry, that goal has now been far surpassed with the US playing the role of prolific exporter. As great as it is to not have our economy subject to the whims of unstable Middle Eastern countries or Russia, is dominating oil and gas paving the best path to long term domination in the energy technologies of tomorrow? The current success is not guaranteed to last without strategic foresight and adaptation. In this article I try to delve into the key insights from the report, while also pondering a bigger question. Now what?

The Rise of a Hydrocarbon Powerhouse

The U.S. energy sector has undergone a remarkable transformation over the past two decades. Oil production, including crude, condensate, and natural gas liquids, has tripled since 2010, now accounting for 20% of global supply. Natural gas production has doubled since 2005, making up a quarter of the world’s output. This surge has positioned the U.S. as the largest exporter of liquefied natural gas (LNG) and the third-largest exporter of crude and condensate, reshaping global energy markets. Notably, U.S. LNG exports have bolstered Europe’s energy security following Russia’s 2022 pipeline cuts, while our record oil volumes have insulated the U.S. economy from global supply shocks.

This growth is underpinned by four key strengths:

- Cost Reductions: Breakeven prices for unconventional oil and gas have dropped by up to 65% since 2005, thanks to technological innovations and efficient supply chain management.

- Flexible Capital: The U.S. industry’s ability to rapidly adjust capital expenditure in response to market conditions has enabled quick scaling and resilience.

- Investor-Friendly Policies: Stable and attractive tax frameworks have retained over 65% of net present value for producers, drawing significant investment.

- Consolidation and Innovation: A robust M&A market, with over $100 billion in transactions in recent years, has driven technological advancements and efficiency gains.

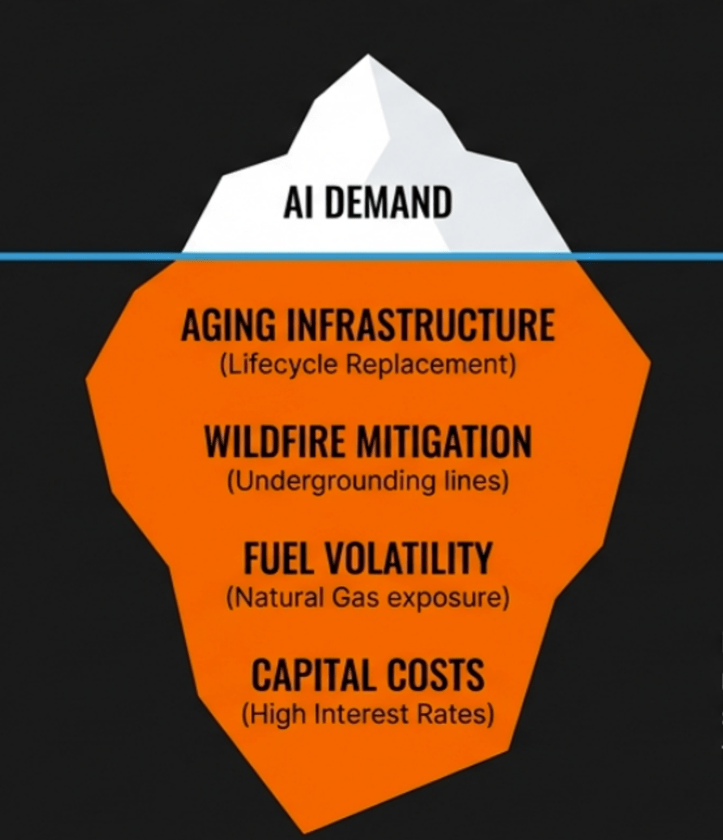

Challenges on the Horizon

Despite this success, the report highlights looming challenges that could erode U.S. dominance. Maturing shale resources mean that the industry must replace natural declines equivalent to Norway’s output annually just to maintain current levels. Fixed dividend commitments and the declining oil prices this year could further constrain reinvestment, while tariffs and carbon taxes may limit export competitiveness. Wood Mackenzie forecasts a production decline of 1.7 million barrels of oil equivalent per day (boed) between 2035 and 2040, with the peak potentially arriving in the early 2030s if prices drop to $50 per barrel. With crude closing in the 50’s on multiple days this month we can certainly see there from here.

A Shifting Competitive Landscape

Perhaps the most significant external challenge comes from China. While the U.S. leads in fossil energy, China is rapidly becoming the dominant force in low-carbon technologies — from EVs and solar panels to energy storage. As the world decarbonizes, this “electrostate” model could supplant the “petrostate” advantage the U.S. now enjoys.

In 2025 alone, China is expected to command:

- 20% of global EV exports

- 30% of the battery market

- 46% of all renewable energy production (compared to 15% from the U.S.)

While oil and gas will likely fuel over 50% of global energy for the next two decades, the shift toward low-carbon technologies could pressure the U.S. economic development prospects and producers if they fail to diversify and deleverage while prices are still strong in relative terms.

Pumping all we can now makes a lot of sense if we think these resources will just be stranded longer term. The question is can we walk and chew gum at the same time. Can we use this current independence and strength in oil and gas to fuel our pursuits of nuclear, solar, storage and an advanced grid for tomorrow?

Strategic Pathways Forward

To sustain its leadership, the U.S. must leverage its strengths while adapting to a changing world. The report suggests three critical actions:

- Innovation Collaboration: Major players like ExxonMobil are pioneering AI-driven subsurface diagnostics in the Permian Basin, potentially lowering costs by $5 per barrel. Industry-wide adoption could extend the basin’s production life.

- Grassroots Exploration: With exploration spending down 65% since 2012, renewed efforts in regions like the Utica and Uinta could replenish low-cost inventories.

- Regulatory Enablement: Streamlining pipeline permits and enhancing fiscal incentives, such as broader drilling cost deductions, could unlock new growth.

However, the report cautions against over-reliance on upstream oil and gas. As global decarbonization gains traction, the U.S. must pivot towards technology focused on electricity generation and low-emission solutions for transportation to remain a dominant energy supplier. I am personally fine being the last in my neighborhood driving an gasoline car, but I don’t want my kids to be the last in the world tied to ICE vehicles.

a future for Our Industry and OUR CuSTOMERS

For energy professionals, the message is clear: innovation and adaptability are non-negotiable. Companies should invest in cutting-edge technologies and explore untapped resources while advocating for supportive policies. Large consumers of energy and fuels should monitor these trends, as a potential U.S. production decline could impact supply stability and pricing, especially if China’s low-carbon exports grow.

Diversifying our energy portfolio as a country — blending traditional fuels and natural gas with nuclear and solar will mitigate the risk of tunnel vision. It is not just “all of the above”, it is a deliberate and sequential investment and development strategy for the country that uses the strengths of today as the strongest bridge to tomorrow.

Final Thoughts

The U.S. energy story is one of triumph, but also a reminder that dominance requires constant evolution. As Wood Mackenzie aptly concludes, “It’s tough at the top,” and dominance isn’t just about scale — it’s about resilience, adaptability, and foresight.

U.S. oil and gas still has room to run, but the race is changing. For energy leaders, investors, and consumers, understanding this inflection point is critical. The world may still run on hydrocarbons today, but tomorrow’s winners will be those who know how to lead through transition.

Leave a comment