There’s been a lot of news coverage about California gasoline prices possibly topping $8 per gallon — a headline-grabbing figure that’s deliberately aimed at alarming everyday consumers. These concerns are often tied to the looming shutdown of a few California refineries and the fear that reduced in-state production will lead to severe supply shortages and sky-high prices.

But let’s step back and look at what’s really happening. This is a FUD – Fear, Uncertainty, and Doubt campaign that seems designed to direct consumer anger at the refiners who supply California with fuel. Ignore the reality that refiners fleeing California is exactly as designed by the Governor and by the California Air Resources Board (CARB).

1. Governor Gavin Newsom’s Administration:

Governor Newsom has vigorously implemented policies to phase out gasoline-powered vehicles by 2035 and reduce reliance on fossil fuels. His administration acknowledges that these policies may lead to higher gasoline prices but views this as a necessary step toward environmental objectives. Newsom stated, “We are undertaking the largest transformation of the energy system we’ve ever attempted,” emphasizing the deliberate shift away from fossil fuels despite potential cost implications for consumers. The US Sun Politico

2. California Air Resources Board (CARB):

CARB has revised the Low Carbon Fuel Standard (LCFS) to increase emission reduction targets, a move that could raise gasoline prices. The board argues that these changes are essential to fund charging infrastructure for zero-emission vehicles and meet the state’s carbon neutrality goals by 2045. While acknowledging potential cost increases, CARB maintains that the long-term benefits of reduced emissions and improved public health justify the measures. AP News

Refinery Closures Are a Resilience Issue — Not a Price Explosion Trigger

It’s true that several California refineries are shutting down or converting to produce renewable fuels. This does make the state more dependent on fuel imports, increasing the risk of price volatility during unplanned outages or global supply chain disruptions. Resilience and reliability are legitimate concerns.

But will that alone push prices to $8 per gallon?

Let’s do the math. An $8 gallon of gasoline implies a crude oil equivalent of around $336 per barrel. Today’s global benchmark prices for crude oil are under $70 per barrel — and there is no shortage of refineries around the world that would gladly supply finished gasoline well below those levels, even with transportation costs added in. Do all of them make the boutique CARB spec gasoline? No. Could they and would they for hundreds of dollars per barrel, of course.

If California gasoline truly reached $8 solely because of a shortfall in local refining, it would become one of the most profitable arbitrage opportunities in global energy markets — and attract imports in droves. Markets respond. Supply flows.

What Does Drive High Gasoline Prices in California?

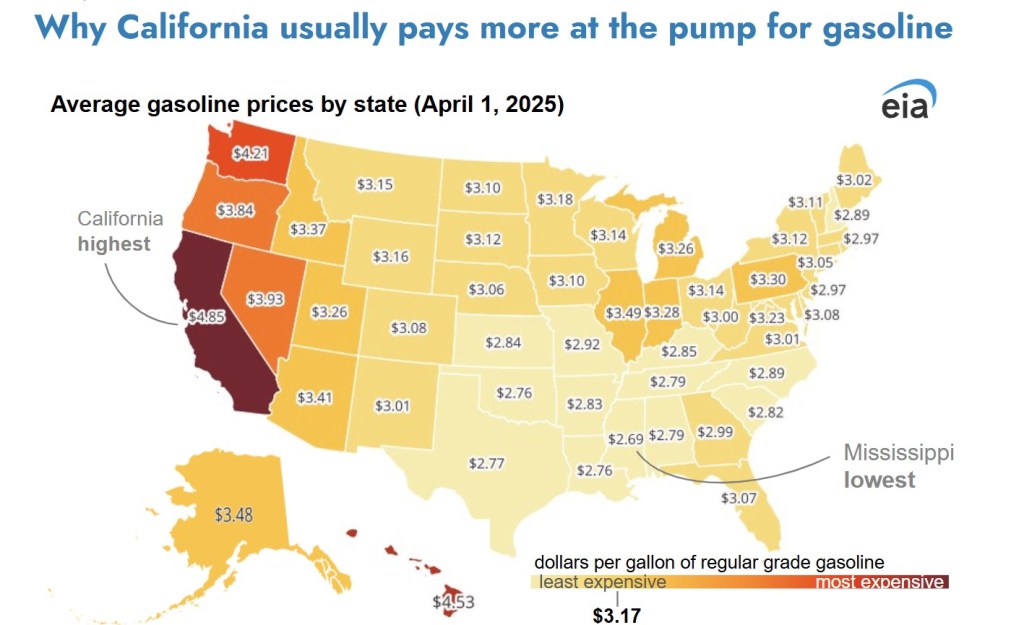

The more systemicly — and less talked about — reason California gasoline prices are routinely $1.50 to $2.00 higher than the national average has little to do with refinery closures.

Instead, it comes down to:

- Higher state gasoline taxes

in March 2025, the U.S. Energy Information Administration (EIA) estimated that taxes and fees, including state excise tax, state sales tax, and the underground storage tank fee, made up $0.72 per gallon of the price of gasoline in California. This compares to a national average around 39 cents. EIA - Cap-and-trade and LCFS costs

California’s Cap-at-the-Rack carbon pricing and Low Carbon Fuel Standard (LCFS) programs add considerable costs at the wholesale level. These environmental compliance programs aim to decarbonize the fuel supply, but they also raise the base cost of delivering gasoline. - Unique fuel blend requirements

California’s boutique fuel blends are designed to reduce smog and meet air quality standards. But they are more expensive to produce and limit where fuel can be sourced from in an emergency. - Tight regulations on infrastructure

Building or upgrading fuel infrastructure in California is a regulatory maze. That slows down supply responses when disruptions occur, and adds cost across the board.

A Policy-Driven Premium

In short, it’s not a global crude oil shortage or a total breakdown in local supply that’s behind California’s high prices. It’s a policy-driven price premium — one that’s layered in by design.

And while some of those policies are driven by environmental goals that enjoy public support, it’s important to be transparent about trade-offs. The burden of those costs is falling hardest on everyday Californians, particularly lower-income households and workers who can’t afford to switch to EVs or relocate.

These politicians and environmental groups are now realizing that the backlash for prices this high is going to be significant. To try and head this off they are furiously trying to convince the public that it’s because greedy oil company’s are shutting down capacity so they can charge more and increase profits, don’t fall for it.

What To Watch

Yes, reduced refining capacity in California increases the risk of price volatility. But that’s a resilience issue — not an economic inevitability of $8 gasoline. As long as global refining margins and crude prices remain reasonable, basic supply-and-demand economics will prevent gasoline from reaching levels that defy the logic of global trade. But, this assumes that imports are allowed to reach the California market.

If shipping is restricted by fears of a spill or import terminals are closed because of environmental or traffic concerns, then consumers will suffer even more than they do today. Will they see $8/gal under those conditions, it is still unlikely, but not impossible.

Hopefully, the next time someone claims that refinery closures alone will send California prices sky-high, it’s worth asking: what’s actually in that price of a gallon? Its a brew of taxes, fees, credits and one off specifications, all which often add up to more than the cost of the actual product.

Leave a comment