🛢️ Fuel Markets Update – June 2025

Are we heading into summer with stronger margins or softer demand? The latest Oil Manual from Morgan Stanley suggests that while crude markets are showing signs of stability, the products side—especially for transport fuels—has shifted meaningfully since the last months update.

Here’s what’s changed:

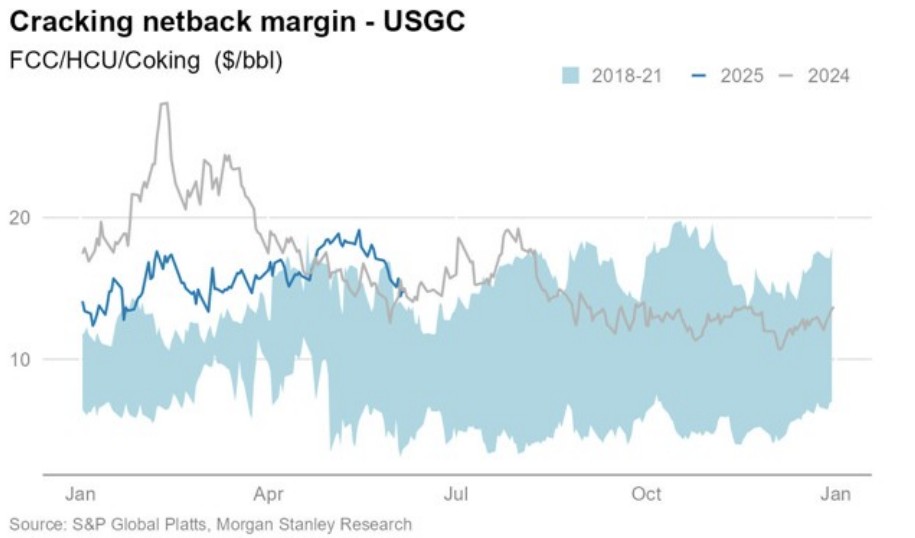

🔧 Refining Margins: Trending Softer

Key Insight: While we are still top of the 5 year range we are now seeing global refining margins showing signs of softening after a springtime high.

- U.S. Gulf Coast margins have declined from recent peaks, led by weakening diesel and jet fuel cracks.

- Margins in Europe and Asia are following suit, especially where export economics are tied closely to diesel demand.

🚛 Diesel: Cracks Have Eased Noticeably

Key Insight: Diesel cracks have weakened as inventories build and global freight remains subdued.

- Middle distillate cracks (diesel and jet) were a major driver of high refining margins in early 2025.

- Now, diesel cracks are trending lower in all major hubs (U.S., NW Europe, Singapore). That said like cracks overall we are still at a relative high, we’re just coming off of some crazy years that now seem to be reverting towards the longer term mean.

- The soft freight market and mild industrial activity are dragging diesel demand.

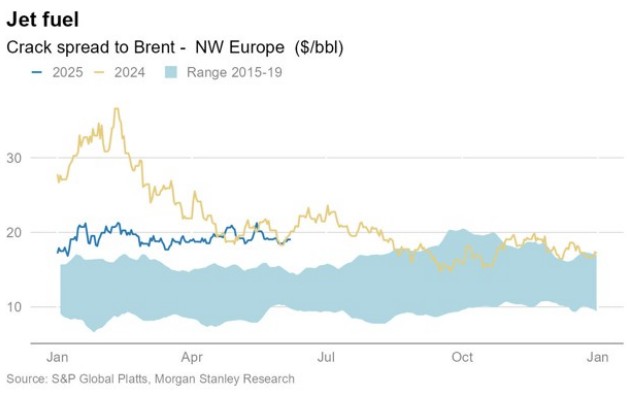

✈️ Jet Fuel: Seasonal Strength Not Enough

Key Insight: Jet fuel margins aren’t showing the seasonal strength we saw into last summer, but here again this is still pretty darn good and well towards the top of the long term range.

- Even with summer travel ramping up, jet cracks remain muted.

- Morgan Stanley suggests this points to softer-than-expected international aviation demand or oversupply.

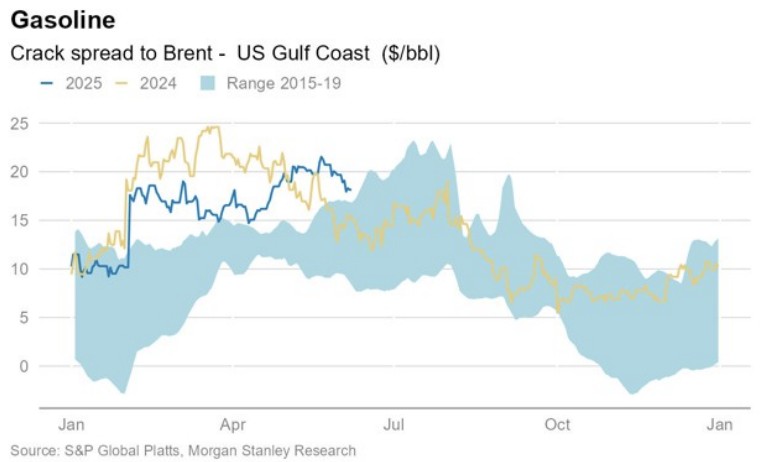

🚗 Gasoline: Better Than Distillates—But Also Cooling

Key Insight: While still really, really good, gasoline cracks continued to peak earlier in the year than they historically have and have softened slightly from May to June.

- U.S. gasoline cracks remain supported by robust driving season demand but are off highs.

- Export demand to Latin America is steady but not enough to offset broader margin pressure.

🧠 Takeaway: The Products Market Has Cooled

While OPEC+ production remains steady (despite higher quotas), product markets are showing signs of surplus, especially for diesel and jet fuel. In my view this reinforces Morgan Stanley’s outlook of a well-supplied market which all points to possible downward pressure on refining margins in the second half of 2025.

📌 Read More for Further Insights

Further reading and data sources:

Leave a comment