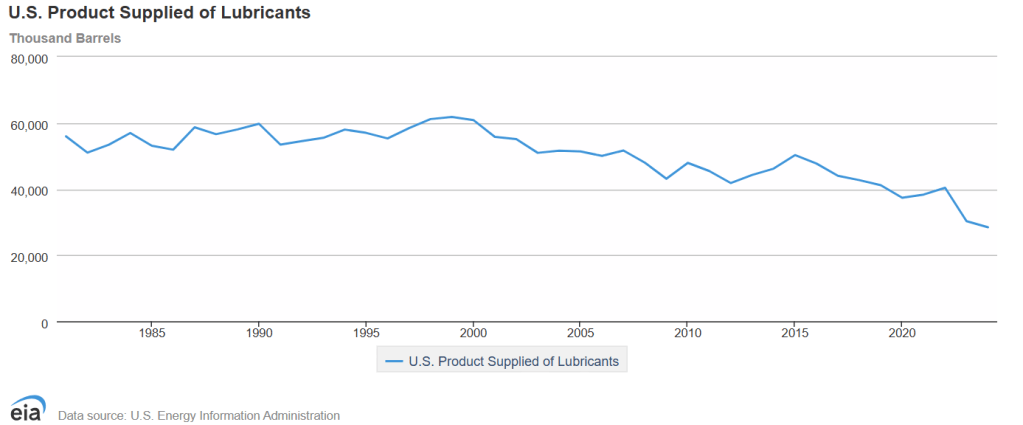

Over the past twenty years, the volumes produced by the U.S. lubricant industry have quietly—but steadily—been shrinking. From a peak of 136,000 barrels per day in 2004 to just 77,800 barrels per day in 2024. While imports and exports impact the amount actually supplied to the domestic US market, our local demand has fallen by roughly similar amounts from the peak in the late 1990’s based on U.S. Energy Information Administration (EIA) data, chart below. While seasonal swings remain consistent, the long-term trajectory points unmistakably downward.

I often get asked why I have stayed invested in this sector in the face of this decline. Why have I continued to spend time on the Board at BioBlend? Why have I historically been willing to pursue acquisitions over the past 15 years that included significant lubricant lines of business? Well volumes matter, but they are not everything . Where exactly you make your money and what kinds of products you supply really makes all the difference. Certainly true for almost any market, the lubricants industry is no different.

First lets understand what’s really driving the overall decline? Why are some sectors faring worse than others? Then, perhaps most importantly, let’s look at where the opportunities for growth exist today, even in the face of the overall decline.

Efficiency Over Frequency: Fewer Oil Changes, Less Demand

The automotive sector has seen the most pronounced impact. Innovations in engine design and lubricant chemistry have extended oil drain intervals well beyond traditional norms. In 1988, I was dedicated to changing my oil every 3,000 miles in my first car, a Dodge Shadow equipped with a Turbo charger that I was sure was stressing the oil. I did the oil changes myself, in the driveway.

So from a world where drivers once changed oil every 3,000 miles, many vehicles today go 7,500 to 15,000 miles or more. Very few drivers actually change their own oil and fewer oil changes mean lower volume consumption—even as vehicle miles traveled continue to grow.

This decline is further reinforced by:

- Stringent emissions regulations that have accelerated the shift to synthetic and long-life lubricants

- The rise of electric vehicles, which require little to no engine oil, (but do use other interesting fluids)

- Changing consumer behavior, with greater awareness of sustainability and reduced DIY maintenance

Industrial Sector: A Much More Mixed Outlook

While the automotive sector leads the volume decline, industrial lubricant consumption tells a more nuanced story. Technological upgrades—such as precision machinery, automation, and smart manufacturing—have reduced overall lubricant needs. But the industrial segment is also where we see a glimmer of optimism, especially in the US where reshoring industrial production is now a national priority that where the government, industry and the public all seem to be aligned.

Forecasts suggest a 2–3% rebound in industrial lubricant demand by 2026, driven by:

- A potential uptick in U.S. manufacturing

- Infrastructure investments tied to the $1.2 trillion Infrastructure Investment and Jobs Act

Aside from a return to demand for the typical industrial lubricant products like hydraulic fluids, turbine oils, gear oils and greases, we are seeing rapid growth in specialty applications in aerospace, renewable energy, and data centers. These new and growing industries are generating demand for high-performance lubricants and advanced coolants, creating opportunities for suppliers focused on niche growth with higher margins rather than bulk volume with more commodity like returns.

Bio-Based and Renewable Lubricants: A Quiet Growth Engine

While total U.S. lubricant volumes continue to contract, one segment is quietly gaining momentum: bio-based and renewable lubricants.

These lubricants which are derived from renewable feedstocks like vegetable oils, animal fats, and more recently, synthetic esters, offer high biodegradability, low toxicity, and improved environmental performance. They are especially well-suited for applications in:

- Construction, mining and drilling operations near waterways or drilling through water tables

- Forestry and agriculture, where runoff is a concern

- Public sector fleets, where sustainability mandates apply

Driven by regulatory support and rising environmental awareness, bio-lubricants are forecast to grow at 4–6% CAGR through 2030, significantly outpacing traditional lubricants. This growth is forecast to be strongest in hydraulic fluids, gear oils, greases, and consumable (saw guide, rail curve, penetrating) oils —segments where environmental exposure is high.

Yes, challenges remain, including higher production costs, limited feedstock availability, and performance standardization. However, innovation in advanced esters and bio-based synthetics is narrowing the gap.

For many companies, bio-lubricants are not just a regulatory checkbox, they are a value-based growth strategy that aligns with customer sustainability goals and offers access to premium segments in a mature market.

These Trends are not Cyclical but Structural

The EIA data underscores a fundamental shift: this isn’t a short-term cycle but a long-term structural change. Even major economic shocks—like the 2008 financial crisis or the COVID-19 pandemic—produced sharp but temporary drops. The persistent downtrend, however, reflects:

- Extended drain intervals

- Regulatory-driven reformulations

- Technology-driven efficiencies

- A changing transportation landscape

In short, U.S. lubricant demand has matured—and is unlikely to rebound to early-2000s levels.

From Volume to Value: Navigating the New Landscape

For suppliers, the imperative seems clear: shift the focus from gallons to gross margin. That means:

- Doubling down on higher-margin synthetics and bio-based lubricants

- Expanding traditional lubricants perspective to include more focus on coolants, dielectric fluids, heat transfer fluids, and filled for life electrical systems that are headed into a massive expansion cycle that spans from large transformers on the grid to mobile battery packs powering almost every device.

- Building footholds in emerging markets abroad, where growth of traditional lubricants is still accelerating as countries industrialize their economies.

In any declining market there are always areas where competition is tightening. In the lubricants and fuels segments of our industry we have certainly seen many smaller distributors be consolidated or choose to exit for the past two decades. But, for those that innovate and align with broader sustainability and electrification trends, new opportunities are emerging and these gains can represent the opportunity to build a thriving business, even in a shrinking market.

Leave a comment