With Trump scheduled to meet with Putin on the war in Ukraine and looking for any points of additional leverage India is finding it’s oil market trying to balance geopolitical pressure and a growing demand discounted Russian crude oil. I wanted to dig into the underlying market fundamentals in India first in a market that I see as one of the major drivers of global growth for the next few decades. Is India the next China? No, but it is quickly becoming a primary driver of demand growth, not just in oil but for energy overall and these escalating trade threats from Washington are putting New Delhi’s energy strategy to the test.

Summer in India Shows Resilient Demand Growth

In June, Indian oil demand held at +2% year-on-year, a steady pace driven by robust gasoline (+7%) and LPG (+9%) growth. Monsoon rains, which arrived early and were heavier than normal, temporarily dented travel and construction fuel demand, pulling gasoline and diesel down month-on-month. But structurally, the main drivers of long term demand growth remain intact:

- Passenger car sales are still dominated by internal combustion engines, with fossil-fuel vehicles making up 84.5% of June sales.

- SUV penetration continues to rise, now over 50% of new passenger car sales, displacing smaller, more fuel-efficient models.

- LPG demand remains underpinned by clean cooking adoption, even as petrochemical feedstock switching fluctuates with price moves.

Diesel demand slipped in June as the rains hit construction and mining, but industrial output indicators stayed strong, buoyed by a 16-month high in manufacturing PMI. Jet fuel demand growth slowed to +3% YoY, reflecting seasonal travel patterns and weather-related flight disruptions.

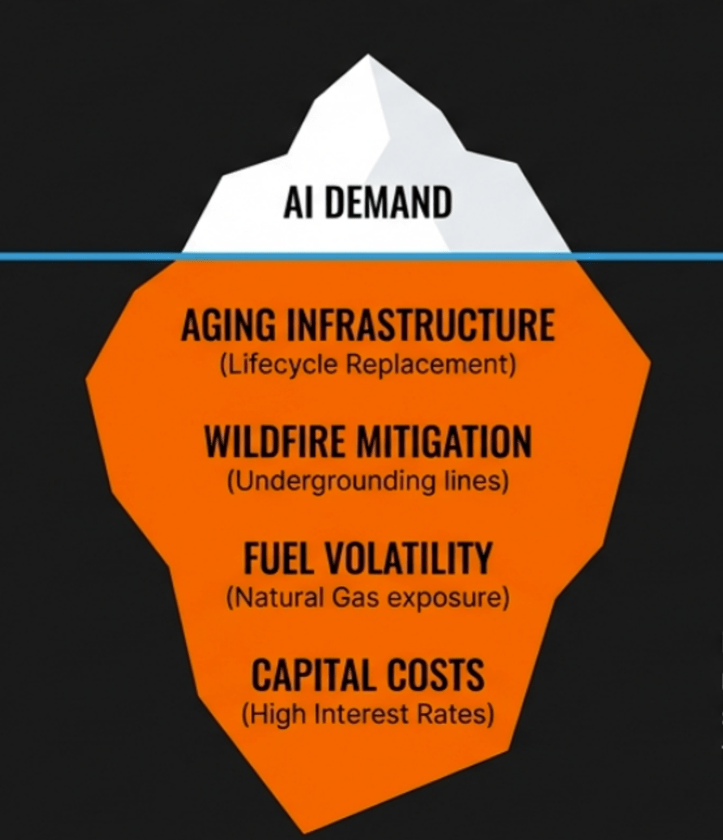

Refining: High Utilisation but Disrupted by Sanctions

Indian refiners processed 4.96 million barrels per day of crude in June, an all-time high for the month. Runs were marginally lower month-on-month due to planned maintenance at ONGC’s Mangalore refinery, but utilization remained high at ~105%. The big shift came in late July, when the EU sanctioned Nayara Energy’s Vadinar refinery which is 49% owned by Russia’s Rosneft, based on their processing Russian-origin crude. The 405 kb/d facility has since cut throughput by 20–30%, highlighting the real operational risks refiners have tied to sanctions.

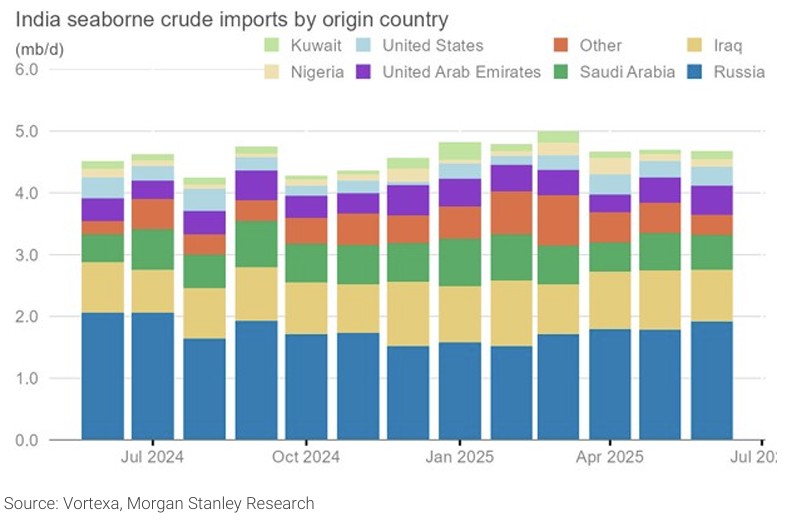

Crude Imports: Russia Still on Top

Russia accounted for 38% of India’s crude imports in June, led by the medium-sour Urals grade but also including record-high imports of the ESPO blend. Middle Eastern imports slipped as refiners leaned into discounted Russian supply, chart below.

But the discount is narrowing. Urals prices in early July were the least competitive since 2022, driven by strong demand and lower Russian exports. Add to that the new EU ban on fuels made from Russian crude and President Trump’s threat of 25% tariffs on India for its Russian oil purchases, and the calculus changes. In the second half of July, Russian crude imports fell by ~200 kb/d as Indian refiners bought alternative grades from Abu Dhabi and West Africa as insurance against supply disruption.

Geopolitics Meets Market Fundamentals

The U.S. move toward “secondary tariffs” is aimed at cutting Russia’s oil revenue, but in practice it risks squeezing Indian refiners between affordable supply and geopolitical penalties. The stakes are high:

- Around 1.55 mb/d of Indian crude imports come from Russia and could be targeted.

- India exports ~15% of its refined products to the EU, a trade now partially constrained by the new sanctions framework.

- Domestic fuel demand is still expanding, meaning supply diversification will be essential to avoid price spikes.

Despite the pressure, Indian government sources have signaled no intention to stop buying Russian oil, citing energy security and cost considerations. The likely outcome is a reshuffling of sourcing with more Middle Eastern and African barrels in the near term but maintaining the higher levels of Russian imports at a politically and logistically sustainable level. The Saudi’s certainly have market share to win back given the shifts that occurred after the start of the Ukraine war, slipping from over 20% down closer to 10% in recent months, chart below.

What to Watch

The next few months will test how far India can insulate its refining system from external shocks without sacrificing domestic fuel affordability. Key indicators will include:

- Russian crude import volumes after the August 8 tariff deadline.

- Refining runs at sanctioned facilities like Vadinar.

- Global diesel cracks, which remain a profit center for Indian refiners.

- Consumer fuel prices, a politically sensitive metric ahead of regional elections.

India’s energy policy has long been a balancing act between price, supply security, and diplomatic alignment. In 2025, that balance is being recalibrated in real time under the weight of monsoon rains at home and political storms abroad.

I expect we will see India finesse these pressures fairly well. The US and Russia both need them for different reasons, and just as they successfully stayed non-aligned during the Cold War they are poised to do so even more successfully this go around. With China casting the deepest shadow it creates a lot more room for India to push harder for accommodations from all sides, especially with Pakistan largely sidelined.

Leave a comment