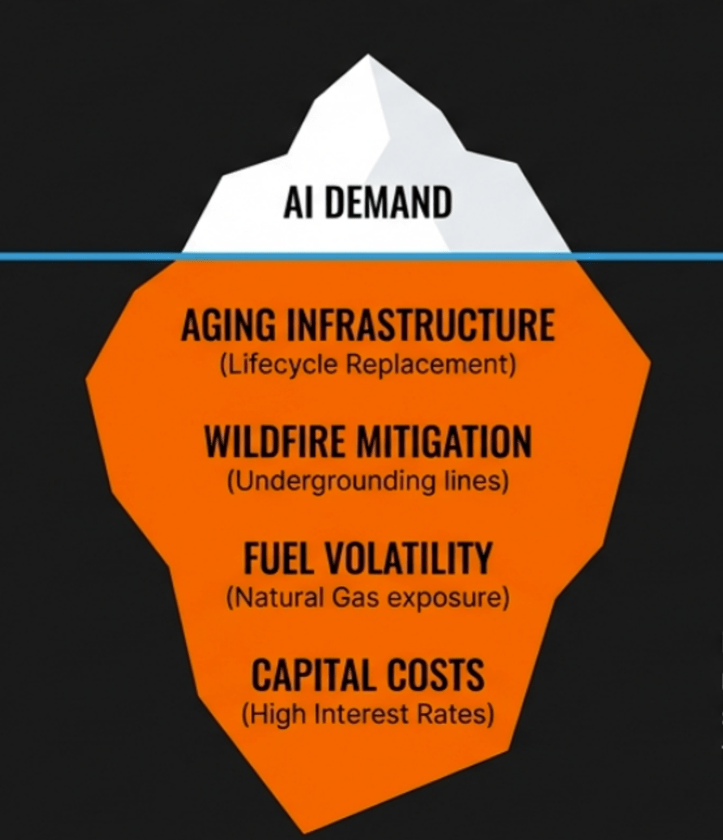

For decades, certainly for all of my life, the American industrial base has relentlessly thinned out, mostly through offshoring and supply chain repositioning to China. The covid pandemic created a questioning focus on the brittle condition this hollowing out of US industrial capacity had created, only to be followed by near panic in many industries after Russia invaded Ukraine.

Regardless of the driver for contemplation, the conclusions are clear, the overreliance on imported critical components has left the United States more vulnerable than leaders realized at the time. In every board meeting, strategy retreat, and certainly within the national security and defense sector the end of this cycle is being declared and decided. This long term trend wasn’t sudden, it played out over the last 50 years, but the reversal won’t be as gradual or measured. What took 50 years to do, will be undone in 10 or 20.

The newly released 2025 National Security Strategy makes the shift unequivocal: the United States is entering a period of deliberate reindustrialization, powered by domestic energy, focused on supply chain sovereignty, and reinforced by a renewed emphasis on defense readiness. At the same time, private capital is accelerating U.S. reshoring and building new domestic capacity in ways not seen in decades.This combination of policy + capital + energy, sets the stage for what I believe will become the Industrial Rebuild Decade.

This is going to transform entire industries across the country and I have been thinking about many of the knock on effects in the lubricants sector. I wrote a few months ago about why I have continued to stay invested in the sector despite decades of declining demand, ( you can read that piece HERE ). Now I believe the reindustrialization now underway is reinforcing the opportunities that are now coming to this sector. For those resilient lubricant manufacturers that have withstood years of consolidation of suppliers, competitors and customers this reversal of so many decades is going to be a pleasant change.

A Strategic Shift in Washington

The 2025 National Security Strategy articulates a dramatic realignment of national priorities:

“The future belongs to makers. The United States will reindustrialize its economy, re-shore production, and rebuild the world’s most robust industrial base.”

That is not just rhetorical flourish it’s an operational mandate. The strategy calls for:

- Rebuilding the defense industrial base

- Increasing domestic manufacturing capacity

- Securing critical supply chains

- Reducing dependency on foreign producers

- Leveraging American energy to power industrial growth

This is a fundamental reorientation of American economic policy, one with profound implications for energy markets, manufacturing, logistics, and investment. For those thinking that this won’t matter in a few years once Trump is out of office I would challenge that thinking.

This isn’t party politics, sure the language would be different with a democrat in power, but this is a deep rooted change in not just national policy but in market outlook at every level. I don’t sit in any board meetings these days were folks are looking at each other and saying, “yeah it’s fine to leave our supply chain in China, I am sure it will work out”. Exactly no one is taking that position, it doesn’t matter what political party they support.

Lubricants Are Foundational to Industrial Capability

Behind every advanced manufacturing process, every energy system, every military platform, every transportation network, and every piece of mission-critical equipment is a set of highly specialized fluids:

- Metalworking fluids for machining

- Gear oils for industrial gearboxes

- Hydraulic fluids for equipment and aerospace systems

- Turbine oils for power generation

- Synthetic greases for defense components

- Compressor oils for petrochemical and LNG facilities

Nothing runs without them. Reliability depends on them. Uptime pivots on the functions they provide. Precision manufacturing with today’s robots and automation requires more of them.

Lubricants are not a footnote to this story, they are the industrial blood supply. As America reindustrializes, lubricant consumption will rise in lockstep. And because the NSS explicitly rejects foreign dependence for critical components, domestic producers gain strategic importance.

Defense Industrial Base Expansion can be a Powerful Demand Driver

Nowhere is this shift going to be more immediate than in defense. For the United States to increase production of aircraft, ships, precision weapons, ground systems, and advanced munitions, it must scale a vast ecosystem of suppliers and lubricants are embedded at every stage:

- Precision machining

- Component assembly

- Maintenance

- Storage and corrosion protection

- Field-level performance and reliability

This is not a small increase. It is a multi-year production mobilization.

“America requires a national mobilization to produce the most capable systems and munitions at scale.” —2025 NSS

Domestic lubricant and specialty producers, particularly independents, form a critical input to these supply chains. I believe those that can lean into these growing areas of demand from defense contractors and those that support them will find exciting new demand growth.

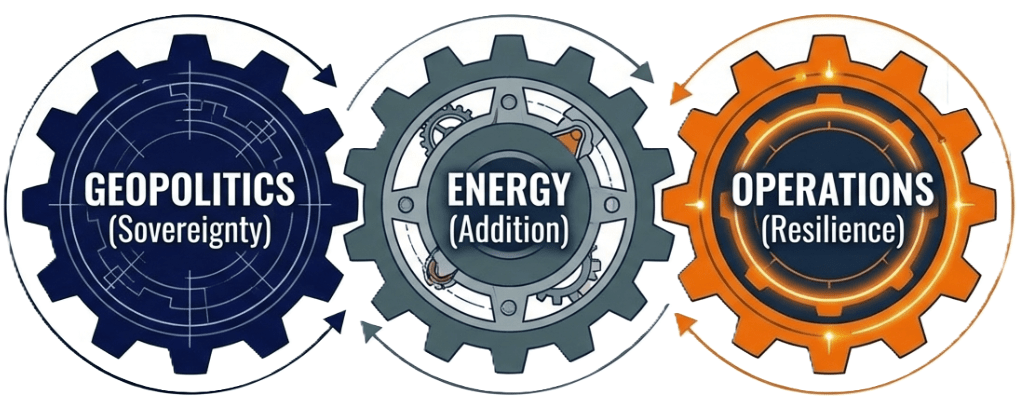

Energy Dominance: The Industrial Accelerator

U.S. energy dominance is not just about exports or geopolitical leverage. It’s about cost structure and competitive advantage.

Low-cost U.S. natural gas and expanding petrochemical capacity lower the cost of:

- Manufacturing

- Refining

- Chemicals

- Plastics

- Fertilizers

- Metals

- Logistics

- Construction materials

Every one of these is lubricant-intensive.

Cheap, abundant energy drives industrial activity

Industrial activity drives lubricant demand

Domestic production ensures supply chain sovereignty

This is the enabling engine of the US industrial rebuild. If we were living in the era of extreme energy dependence that we lived through from the embargo’s of 70’s up until fracking unlocked independence in the 2000’s this would be a very different storyline.

Domestic Manufacturing a Long Hidden and Underappreciated Asset Class Re-emerges

The industrial rebuild will reshape:

- Capital allocation

- Supply chains

- Manufacturing footprints

- Workforce strategy

- Regional economic development

- Infrastructure investment

Positioned to benefit from all of these shifts domestic lubricant producers represent one of the most underappreciated growth potentials in the U.S. economy.

They typically bring:

- Technical expertise

- Close customer intimacy

- Unique formulations

- Fast response times

- An essential combination of flexibility + specialization + reliability

Conclusion: The Quiet Growth Story based on America’s Industrial Future

Lubricant’s role in the US reindustrialization won’t be in headlines but behind every factory startup, every grid upgrade, every oil and gas expansion, every defense production ramp, and every new advanced manufacturing facility domestically produced lubricants will keep the machines running and the systems reliable.

Those companies that have survived and thrived over the past 50 years of industrial collapse in the US may find that they are entering an entirely new market reality, one of abundance and not stagnation. While wonderful news, this shift will create it’s own challenges as leaders figure out how to scale up rather than just optimize what they have. How do they finance, hire, build for an expanding future and not one where the fear of the last plant in town closing up shop drove so many decisions for decades. Going to be an exciting transition, and a lot more fun than the energy transition everyone thought was the only storyline in town.

Leave a comment