Why electricity costs are rising — and what AI-driven load growth gets right, wrong, and misunderstood.

The Real Cost of Power

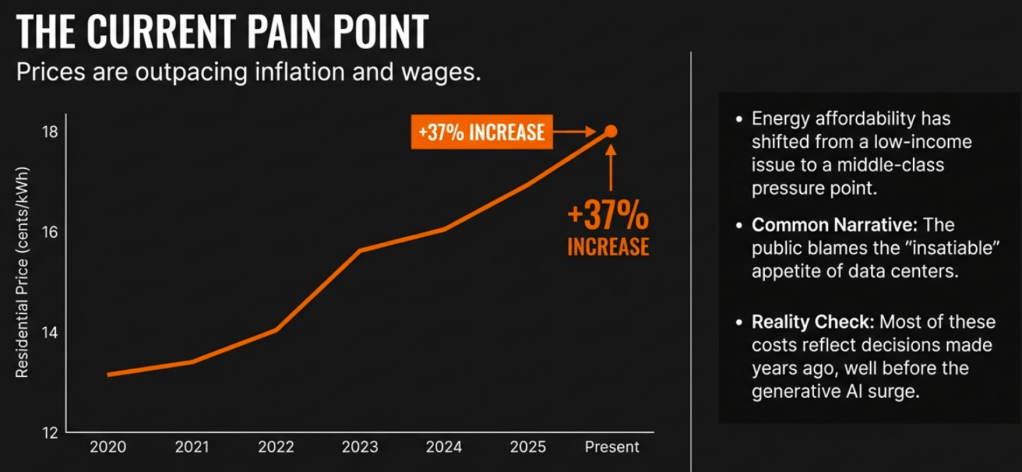

With socialists like Bernie Sanders calling for a moratorium on data centers, and local neighborhoods fighting their county development efforts to prevent permitting, it is clear the plug has become unplugged on electricity markets. These populist responses have gained momentum because electricity prices across the U.S. are rising faster than inflation and wages, pushing energy affordability from a long-standing low-income issue into the middle class. Since it is always easier to create a new bogie man than it is to build understanding about the real issues we have AI being blamed, even before it’s showed up.

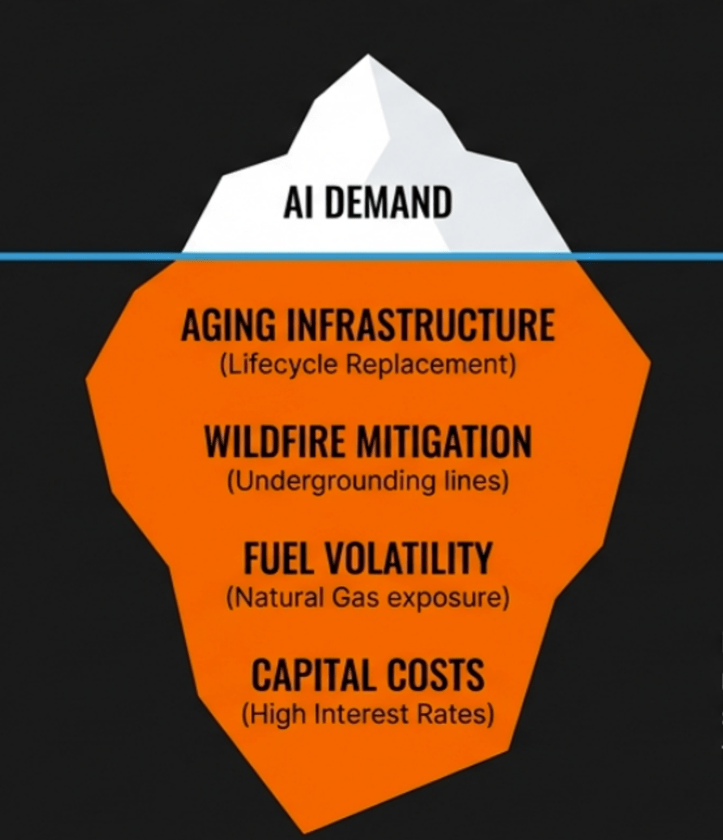

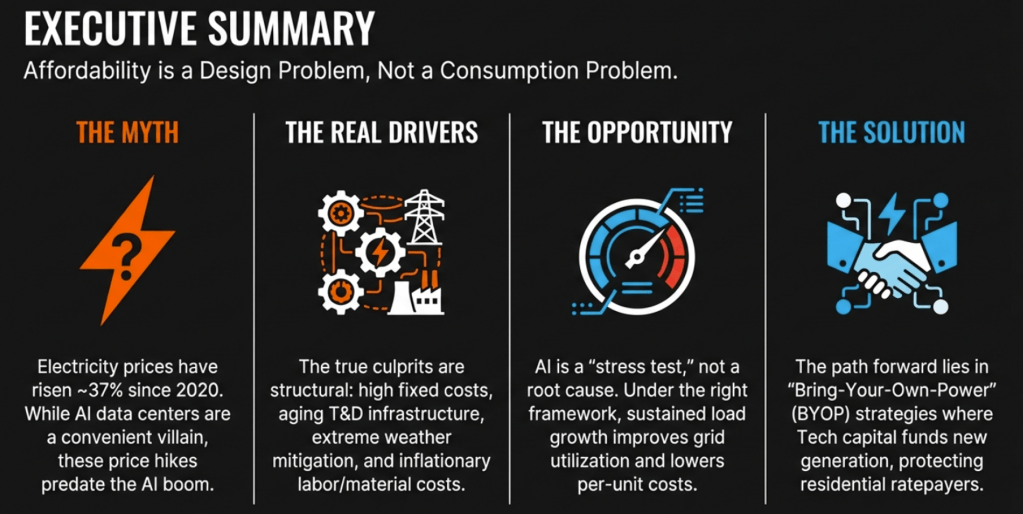

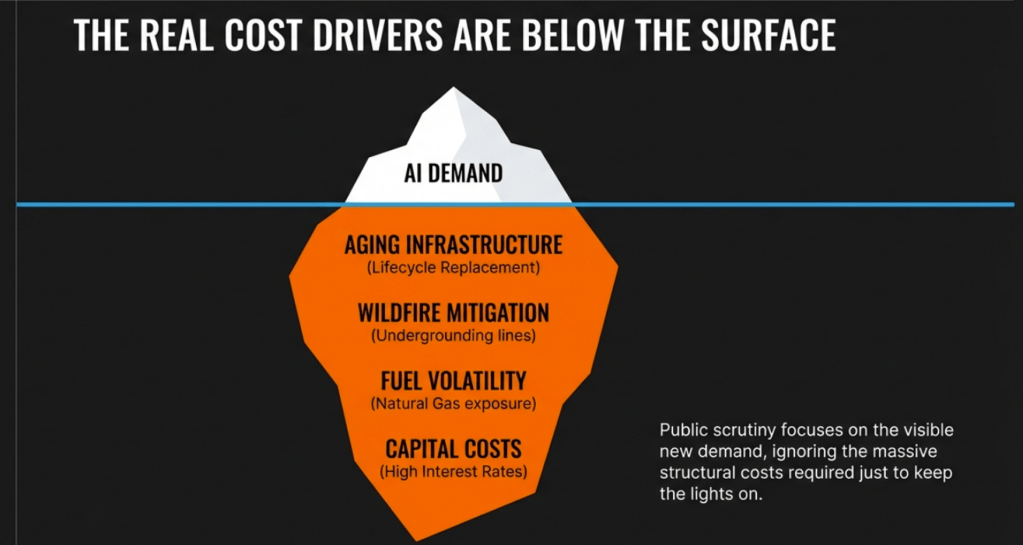

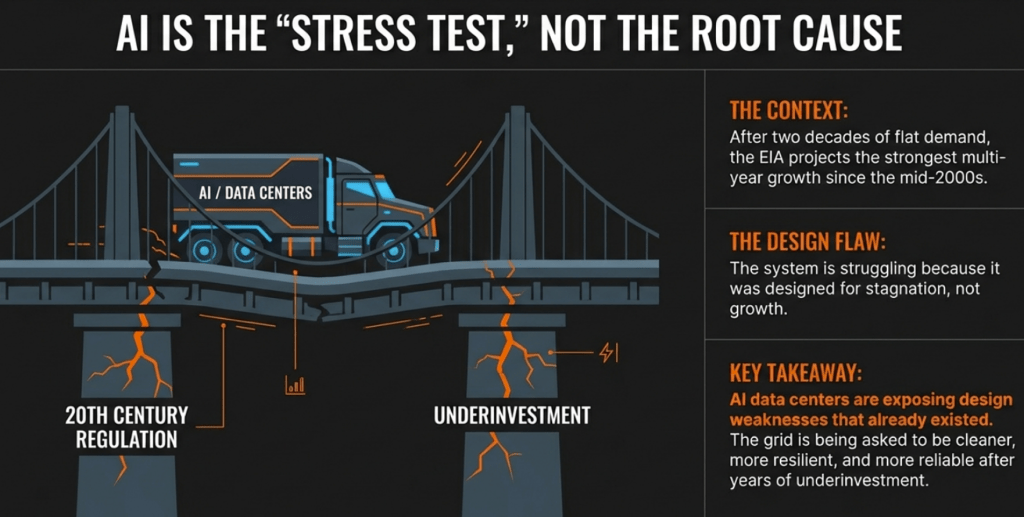

While AI data centers have become a focal point in the debate, they are not the root cause of higher rates. Instead, they are amplifying structural issues already embedded in the power system: high fixed costs, aging infrastructure, fuel volatility, extreme weather, and regulatory models that reward capital spending over outcomes.

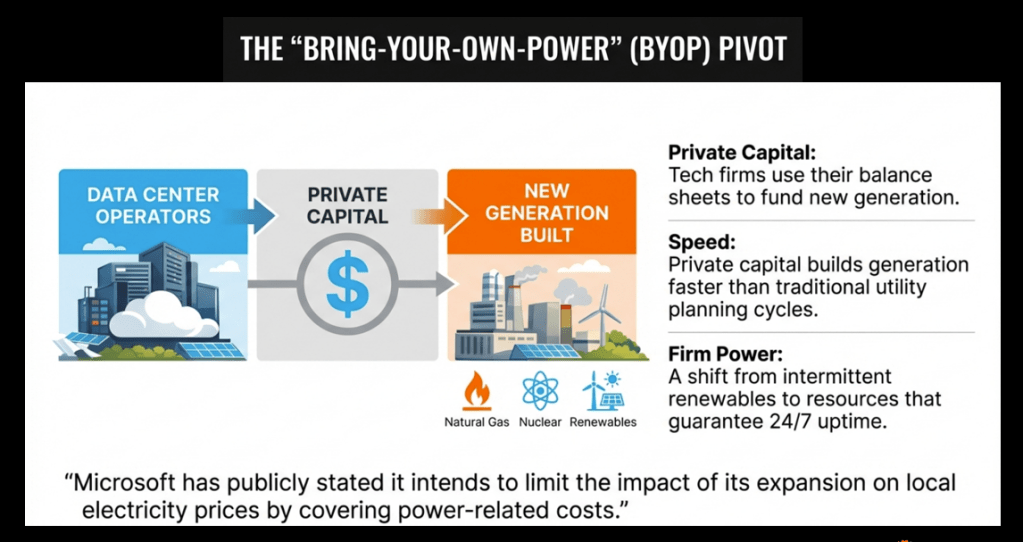

To be clear, AI-driven load growth can raise electricity rates, especially in the near term and in constrained regions, but under the right market design and cost-allocation frameworks, it can also support lower per-unit costs over time. A growing “bring-your-own-power” (BYOP) trend among hyperscale data center operators adds a new dimension to the debate, with the potential to relieve or exacerbate rate pressure depending on execution.

In short: electricity affordability is not an AI problem. It is a system design problem, and AI is stress-testing that design. In this article we will deep dive on how the apparent problem of AI data center demand can become the most important part of the solution, but it will take thoughtful design not reactionary mobs.

Electricity Rates Were Already Under Pressure

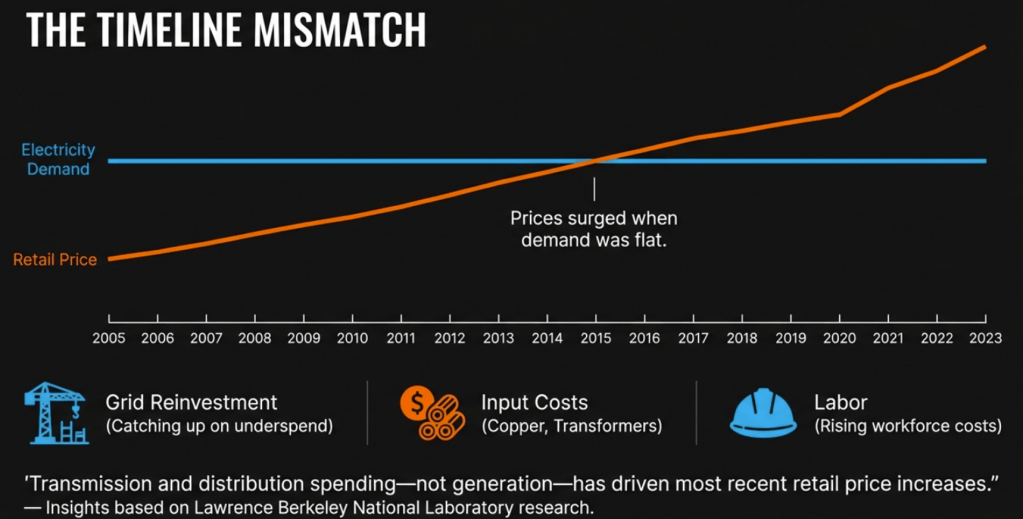

U.S. electricity prices have climbed roughly 37% since 2020, with the national average residential rate now approaching $0.18 per kilowatt-hour, according to the U.S. Energy Information Administration (EIA).

These increases reflect a combination of factors that predate the current AI boom:

- High fixed costs across generation, transmission, and distribution

- Grid reinvestment after decades of under-spending

- Rising labor and material costs, including copper, transformers, and switchgear

- Extreme weather driving grid hardening and wildfire mitigation

- Fuel price volatility, especially natural gas, which still sets marginal power prices in many markets

Analysis from Lawrence Berkeley National Laboratory shows that transmission and distribution spending — not generation costs — has been the dominant driver of recent retail electricity price increases, particularly among investor-owned utilities.

Most of today’s rate increases reflect infrastructure approved and built years ago. There are few short-term levers to reverse them.

AI Data Centers: Load Shock or Load Opportunity?

After nearly two decades of flat electricity demand, the U.S. power system is once again experiencing sustained growth. The EIA expects electricity consumption to rise in 2026 and 2027, marking the strongest multiyear growth period since the mid-2000s.

This is a good thing. We are actually growing the real economy not just the virtual one. Yes, AI data centers are a meaningful contributor to this shift, but they are working alongside electrification of buildings, industrial growth, and of course more electric vehicles.

In regions with tight capacity margins, particularly PJM, aggressive load forecasts tied to data center interconnections have already translated into record capacity market clearing prices, which ultimately flow through to customer bills. So from that perspective, the concern is understandable: rapid, concentrated load growth in constrained systems does raise costs.

But the broader evidence is more nuanced.

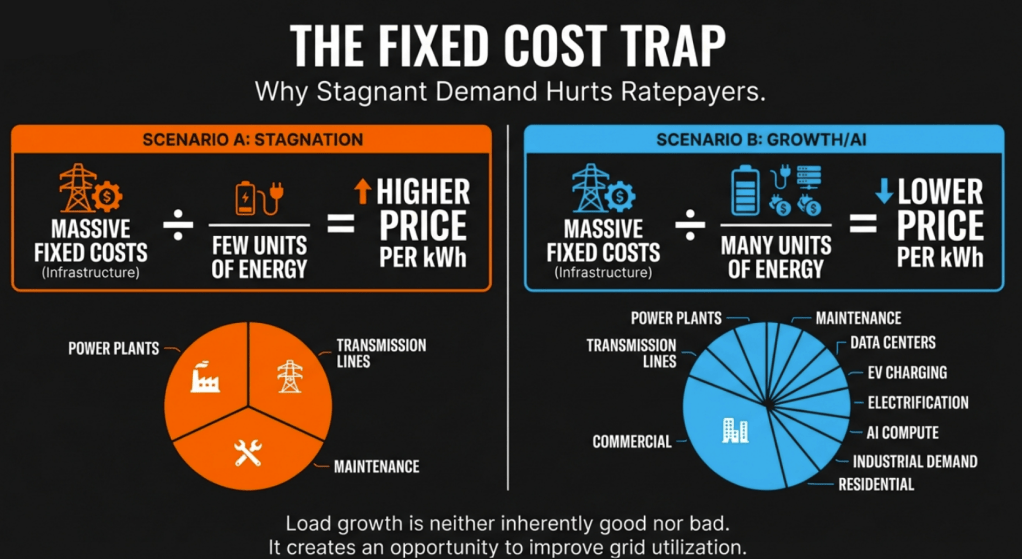

Research finds that states with shrinking or stagnant electricity demand often experienced higher per-unit prices, because fixed grid costs were spread across fewer kilowatt-hours. Load growth, under the right conditions, can improve system utilization and reduce long-run average costs.

The question is: How do we get the new generation resources built as fast as possible and within the right regulatory structure that ensures they contribute the most to grid stability and affordability?

Why Large Loads Feel Different — and More Controversial

Data centers draw disproportionate attention because they are:

- Large and geographically concentrated

- Often supported by state and local tax incentives

- Highly visible compared to other drivers of electricity demand

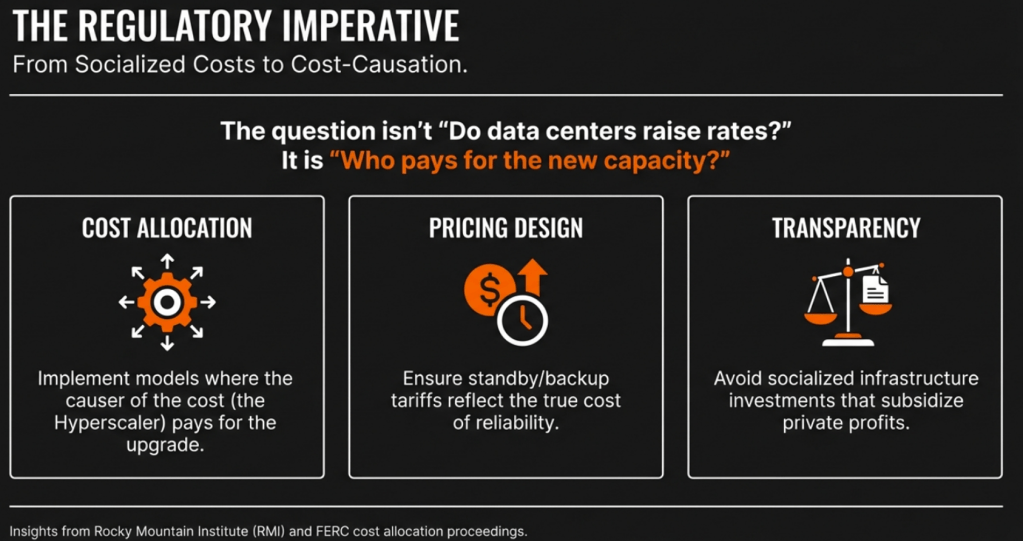

The affordability risk arises when new loads trigger transmission and distribution upgrades that are socialized across all customers, rather than allocated to the customers driving the need for those investments.

Rocky Mountain Institute and other analysts have repeatedly highlighted that cost allocation and regulatory design — not demand growth itself — determine whether customers benefit or suffer from large new loads.

Bring-Your-Own-Power: A Structural Shift in How Load Meets Supply

In response to growing scrutiny, several hyperscale data center operators, including Microsoft, Google, Amazon, and Meta have begun pursuing “bring-your-own-power” (BYOP) strategies.

These approaches typically involve:

- Financing or contracting for new generation capacity

- Supporting firm, always-available resources rather than intermittent supply alone

- Pairing incremental demand with incremental supply funded by private capital

Microsoft has publicly stated that it intends to limit the impact of its data center expansion on local electricity prices and water resources, including covering certain power-related costs tied to its growth.

Other hyperscalers are pursuing similar paths, including backing new gas generation, exploring advanced nuclear options, and contracting for long-duration clean power to support 24/7 operations.

How BYOP Can Improve Capacity and Efficiency

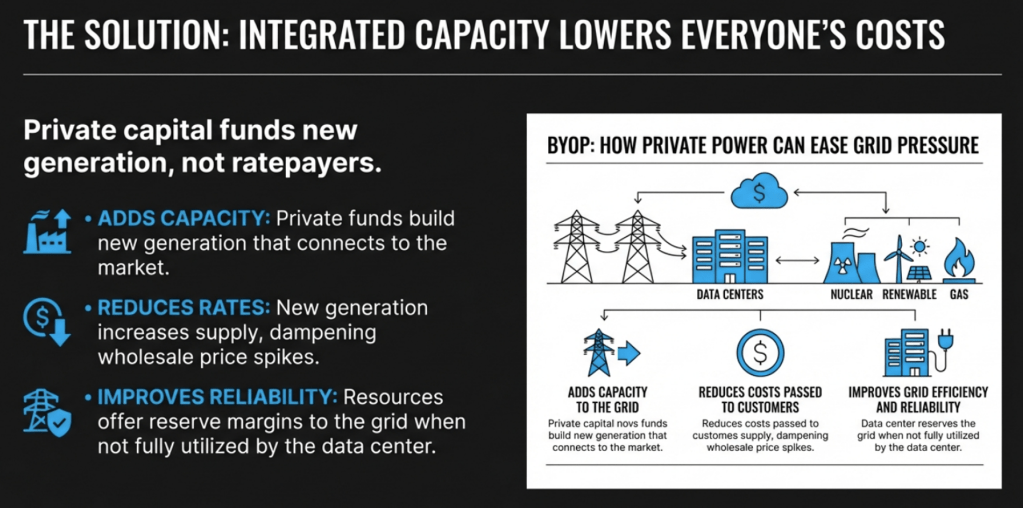

When structured well, BYOP can provide meaningful system benefits.

Faster capacity additions

Private capital can move faster than traditional utility planning cycles, helping bring new generation online sooner and reducing scarcity risk in tight markets.

Improved cost causation

If large loads fund the supply and infrastructure they require, fewer costs are pushed into general rate base — slowing the upward pressure on residential and small commercial bills.

System-wide benefits

When BYOP resources are deliverable into the grid and participate in wholesale markets, they can improve reserve margins, reduce peak price spikes, and enhance reliability beyond a single customer.

Where BYOP Can Still Raise Costs — or Create New Ones

No, BYOP is not automatically pro-consumer, you have to design it to be so.

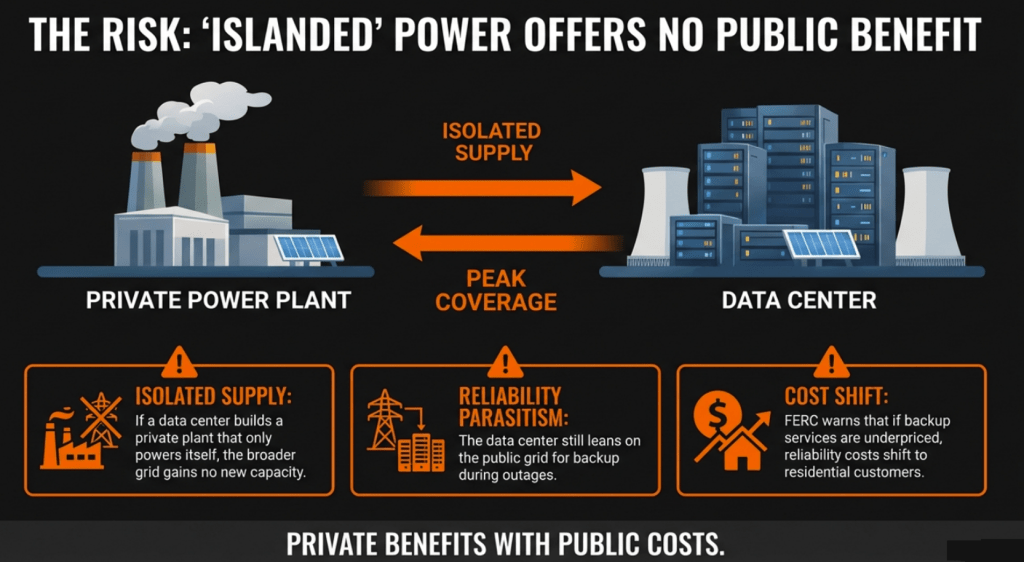

If generation is effectively islanded and is serving only one facility and unable to provide system support then it does little to improve regional reliability or reduce prices.

Even self-supplied data centers rely on the grid for backup and peak coverage, so if they don’t bear their share of the grid costs for that back up guarantee then other ratepayers could be forced to absorb the upgrades.

Federal Energy Regulatory Commission proceedings have repeatedly highlighted the risk that standby and backup services can be underpriced, shifting risk and cost onto other customers if tariffs are not designed carefully.

There are also emissions concerns since many near-term BYOP proposals rely on natural gas for speed and reliability, raising legitimate questions about emissions trajectories and long-lived infrastructure in a decarbonizing system.

The point is that these are clear concerns that can be fairly addressed not issues that should cause us to run from an imaginary boogie man dressed up as AI.

The Wrong Question — and the Right One

The public debate often asks:

Do data centers raise electricity rates?

The better question is:

Who pays for capacity, how fast it is built, and whether the benefits are shared?

AI data centers are exposing design weaknesses that already existed in electricity markets. In regions with disciplined cost allocation, competitive transmission planning, and flexible demand participation, AI load can support more efficient grids over time.

In regions without those features, it can accelerate affordability challenges already in motion.

Bottom Line

Electricity rates are rising because the grid is being asked to do more while also being cleaner, more resilient, and more reliable after years of underinvestment. AI data centers are accelerating that reckoning, not creating it.

Whether AI ultimately raises or lowers electricity costs depends less on megawatts consumed and more on planning, pricing, and policy discipline.

Affordability is not a technology problem or a demand problem it is a system design problem that has many straightforward solutions, lets get on with it.

Read More for Further Insights

- U.S. Energy Information Administration — Electricity prices and demand forecasts

- Lawrence Berkeley National Laboratory — Retail electricity price drivers

- PJM Interconnection — Capacity markets and load forecasts

- Federal Energy Regulatory Commission — Transmission planning and cost allocation

- Charting the data center development roadmap in key US states

- Power Magazine — Data center power and generation developments

Leave a comment