We have probably all heard the tale about the boiled frog. A frog will jump out immediately if dropped into a pot of a boiling water but will sit comfortably and be cooked alive if the water is cold and then very gradually raised to a boil. This tale is starting to feel relevant in the energy business. Major changes in energy consumption are SLOW to materialize. It took us thousands of years to move beyond burning wood as our major energy source. Coal powered the industrial revolution 250 years ago and seems to have peaked in consumption only in the last year. Oil having boomed since that first well in 1869 dominates transportation 150 years later.

The peaking of coal due to substitution of natural gas while not dramatic enough for those who want the demise of all fossil fuels is cold comfort for those working in the collapsing coal business. Yes this switch to natural gas has been hastened by the focus on reducing green house gases and pollutants, but the much broader driver has been fundamental economics that have made natural gas better, faster, and cheaper. The net result is that king coal has lost it’s best market, power generation.

While more broadly useful than coal, oil has one biggest and best market, refined fuels. Fuel for transportation is what drives oil’s value. What if we are now seeing not peak oil in terms of production but peak oil in terms of demand? What if the biggest and best market for fuels is lost to a new substitute? The glacial pace of change that typically occurs in energy make changes like this nearly impossible to see until they have already had a massive impact.

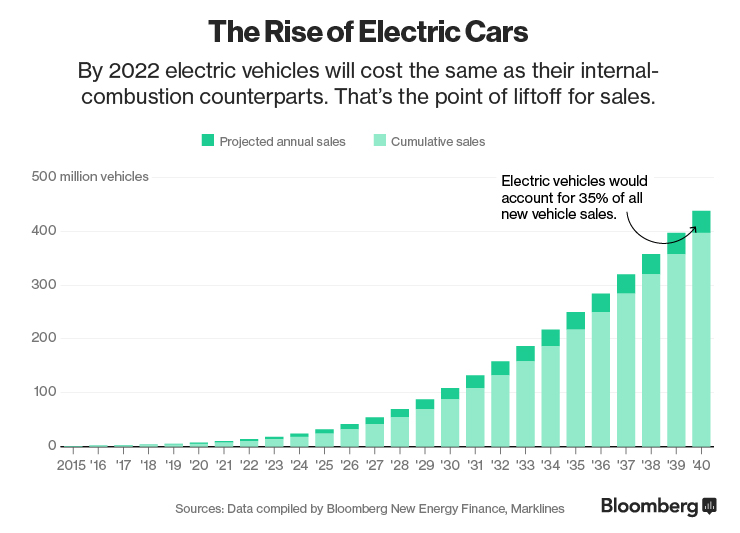

Part of this what if question may be materializing now. We all know that despite the seemingly endless hype around Tesla that electric cars are currently a non-factor. At less than one tenth of 1% of global car sales last year it seems clear that the water in this pot is calm and cool. The heat may however be turned up soon. When looked at a little more closely we can begin to see the power of compound growth start to become evident. As depicted below if the current growth rate of electric vehicles continues they will be 35% of the new car market.

So what right? You mean in 25 years a whopping 35% of new cars might, and I stress the MIGHT, be electric. Slow as this may seem the urgent challenge I see for the current oil and fuels market is that changes on the margin of demand and supply are what drive prices. It is that last barrel or gallon sold that often sets the price for the whole batch. Even bigger than those short term price changes at the margin are the changes in expectations. It is change in longer term expectations, not the current reality, that drive the value of stocks, assets, reserves, and companies.

For proof that changes on the margins of markets can have catastrophic impacts on prices we need look no further than oil’s crash from $100 to $27 a barrel. This crash that wiped out prices by 75% and trillions in market value was all caused by a 1-2% surplus. When looked at in isolation 1 to 2 million barrels a day sounds big, but against 90 million barrels a day in demand it is a tiny amount of the market. Yet this tiny change has been large enough to wreck the worlds largest commodity market. Entire countries are going down, governments are going to fall, and trillions in valuations have been lost, all over a 1-2% surplus.

So what happens when we reach that perhaps mythical horizon where 35% of new cars are electric? Who knows? I sure don’t, but my point is that it doesn’t matter. What matters is the change in marginal prices and expectations. Coal is still worth a lot when compared to most other rocks laying in the ground, but coal companies are not. Why? Because they have been deemed to have no future. If fuels begins to lose their primacy in transportation it won’t be 2040 when trillions will be written down. It will be much sooner when companies and even countries go tumbling over the edge. Using an average demand of 15 barrels per year per car and the current growth rate of 60% Bloomberg predicts electric cars could cause the same 2 million a barrel a day surplus we are experiencing today by 2023.

While this forecast seems possible there are a lot of assumptions that must come true for that to happen. A big assumption behind the rise of electrics is that batteries will continue to decline in price and improve on energy density. I think an even bigger assumption is that internal combustion (IC) engines will largely stand still at today’s levels of performance.

The consumer will always choose better, faster, cheaper. In the case of electric vehicles we have already seen the faster part. We have a four door sedan blowing the doors off all but the very fastest super cars with sub 3 second 0-60 times. If we use that same benchmark of speed and acceleration as your metric then that same sedan is also cheaper. Not cheap enough for mass market, but far cheaper than the $250,000 Ferrari it matches for speed. This is the challenge the fuels industry now ultimately faces. Unfortunately it is one I see very little attention and focus on by most.

While I am worried that we are not seeing more investment in improving the internal combustion engine there is good news here as well. We know it is competition that drives advances and improvements. So perhaps now 100 years after beating the last competitor, the horse, the internal combustion engine will again move forward. How the internal combustion engine evolves and improves is going to be the biggest factor in how long this proven champion can hold onto the title.

So back to my frog story. It seems that many companies who depend on the internal combustion engine continuing to reign supreme are simply basking in their cool bath for now. A lot of focus is on policy and politics not on engineering and manufacturing. Maybe the fuels industry, that spans both oil and renewable fuels producers, can just hope that the current engine manufacturers come up with better internal combustion engines on their own. Hope however is not a strategy.

Engines and fuels are an integrated system. One will not advance without the other. So while the renewable fuels industry and traditional fuels industry bicker and sue each other before the EPA the real competitor continues to evolve at an increasing pace. If EV’s replace gasoline it won’t matter what kind of blend the internal combustion engine is burning because the better, faster, cheaper solution will have replaced it.

I have recently found two places where a productive conversation is happening between automotive manufacturers and fuels producers. The first is at The Fuels Institute. This think tank is bringing together bright minds from all three perspectives. Automakers like Toyota and Fiat Chrysler are working with refined fuels manufacturers like Phillips 66 and renewable fuels producers like Poet to advance the discussion in new and insightful ways. Because of this unique effort and perspective I joined the board of directors of The Fuels Institute this year.

The other place where I see focused efforts to advance the internal combustion engine is Clemson University’s International Center for Automotive Research (CU-ICAR). Located in Greenville, SC this 250 acre research center sits next to a massive BMW plant. They have leading global OEM’s like Michelin and Timken running labs on site that are doing research every day beside most of the world’s largest automakers. This massive campus is led by Zoran Filipi, who encouragingly has spent much of his career driving advances in internal combustion.

I am excited to see places like The Fuels Institute and CU-ICAR working to get more juice out of the 100+ year old champion that is the internal combustion engine. Who will be better, faster, cheaper in the end? Who knows, but one thing is for sure, trillions are on the line. It seems that those making or marketing fuels, renewable or fossil, need to be paying very close attention. Maybe the temperature of the pot will stay calm and cool, maybe not. Either way I would have my best thermometer front and center on my desk every day.